How Covid-19 'sinks' corporate profits 2

FiinGroup has just released a report assessing the impact of Covid-19 on the business results of the group of businesses on the stock exchange.

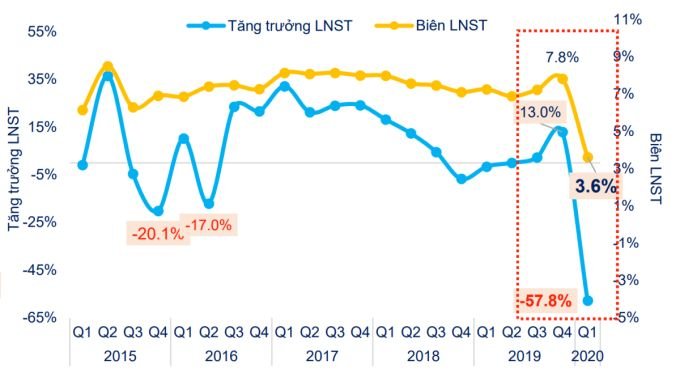

According to statistics, revenue of businesses decreased only 4.4%, profit after tax of businesses decreased nearly 58% compared to the same period in 2019 and nearly 69% compared to the previous quarter.

Corporate profits in the first quarter decreased by nearly 58% over the same period.

The decline in profits occurred in many different industries, especially those directly affected by Covid 19 such as oil and gas (down 303%), entertainment and tourism (down 212%) and real estate

If excluding strongly affected groups, profit after tax of the remaining industries decreased by 27% over the same period and decreased by 50.2% compared to the fourth quarter of 2019.

On the contrary, some industries saw good revenue growth including telecommunications (+23%), retail (+16%), food and beverages (+8.7%), pharmaceuticals (+10

However, in addition to the decline in absolute numbers, profit quality also declined sharply, continuing the decline since the beginning of 2018.

Earnings before interest, taxes and depreciation (EBITDA) in the first quarter decreased by 26% compared to the same period last year and decreased by 33% compared to the previous quarter, establishing the 10th quarter of decline since the end of 2017.

Business revenue decreased by 4.4% in the first quarter, lower than the decrease in profits.

More notably, cash flow from production and business activities (CFO) was also negative for the first time at negative 26,000 billion in the first quarter, from data from 999 non-financial enterprises.

According to the analysis team, due to negative CFO and declining ability to pay interest, businesses have to borrow more to maintain operations.

Cash flow for investment activities (CFI) also narrowed sharply in the first three months of the year.

The positive point, according to the analysis team, is that the indicators of days of inventory processing and days of receivables and payables to customers, although slightly increased, are still not as high as in previous difficult periods.

With less positive results, businesses also plan to see a decrease in profits over the same period, although revenue is still expected to increase slightly.

According to FiinGroup statistics, 426/1644 non-banking public companies, accounting for 71% of total capitalization, have 2020 business plans and most are updated from documents or resolutions of shareholders’ meetings after translation.

This result, according to the analysis team, is a quite large decrease compared to the actual growth of 14.7% in 2019 and 18.2% in 2018 of these 426 enterprises.

However, according to the analysis team, many years of monitoring experience shows that business leaders often tend to build `safe` business plans or lower than expectations.

`If these industries affected by Covid-19 have some surge in business results thanks to the restart of flight routes, vibrant domestic tourism and other macro factors, the picture